Don't Be Shy, Put That Sugar Tax

Indonesia has been delaying its sugar tax implementation since 2016, and I hate waiting. Come on!

Halo and happy Monday!

First things first, I want to say hi to some new readers here, especially those who came from the clock app. Welcome to Kepayang! Here, I write essays and stories on food, sustainability, and culture.

Today’s newsletter, particularly, is very eye-opening. It’s a developing topic, so researching about it can be quite tricky. A lot of reading, going to the supermarkets, and peeking into what other people are doing. You will read about:

🌀How the sugar tax discourse in Indonesia is a neverending one. Also, what even is the sugar tax?

🌏 How the sugar tax being implemented in other countries, and their results and implications.

🤯 The amount of sugar in our drinks. Please read because I went to the supermarket for this.

⏭ How companies and consumers respond to the planned sugar tax, and what happens next to our beloved sugary drinks.

Kepayang is free for now, so any engagements mean so much to support the platform’s growth. You can subscribe to get the newsletter sent directly to your email, like, comment, and share if you resonate with what I write.

Alternatively, you can buy me a coffee through my PayPal here: https://paypal.me/chalafabia - or if you’re based in Indonesia, you can send your donation through QRIS here (under the name Tamanan). Any amounts are welcomed and will directly contribute to sustaining this platform to cover expenses related to operations, research, writing, and marketing. ☕️

I don’t know about you, but I read the news. Sometimes. Not every day. And in those days when I read the news, there’s always this headline about how prices are going up. I’m not talking about the prices of meat and veggies. I’m talking about the prices of bottled drinks – sweetened bottled drinks. Here in Indonesia, the technical term is Minuman Berpemanis Dalam Kemasan (MBDK).

Many drinks fall into this category as the definitions are pretty broad. Quoting Kompas (2024), any drink that is added with a sweetener, be it cane sugar, palm sugar, syrup, honey, or other sweeteners like fructose and glucose can be considered a sweetened drink. This means, your soda, juice, energy drinks, tea, and coffee might be on the price increase list.

You might want to thank the Ministry of Finance for this.

This is because, since 2016, there has been this neverending discourse on whether a tax should be imposed on these sweetened beverages. Up until today, the headlines were practically the same “Get ready! The new sugar tax will apply this year!” - just in different fonts. At the time this essay was being written in April 2024, there were still no clear signs when the tax would be effective.

“Stop right there. What does tax have anything to do with my sugary drinks?”

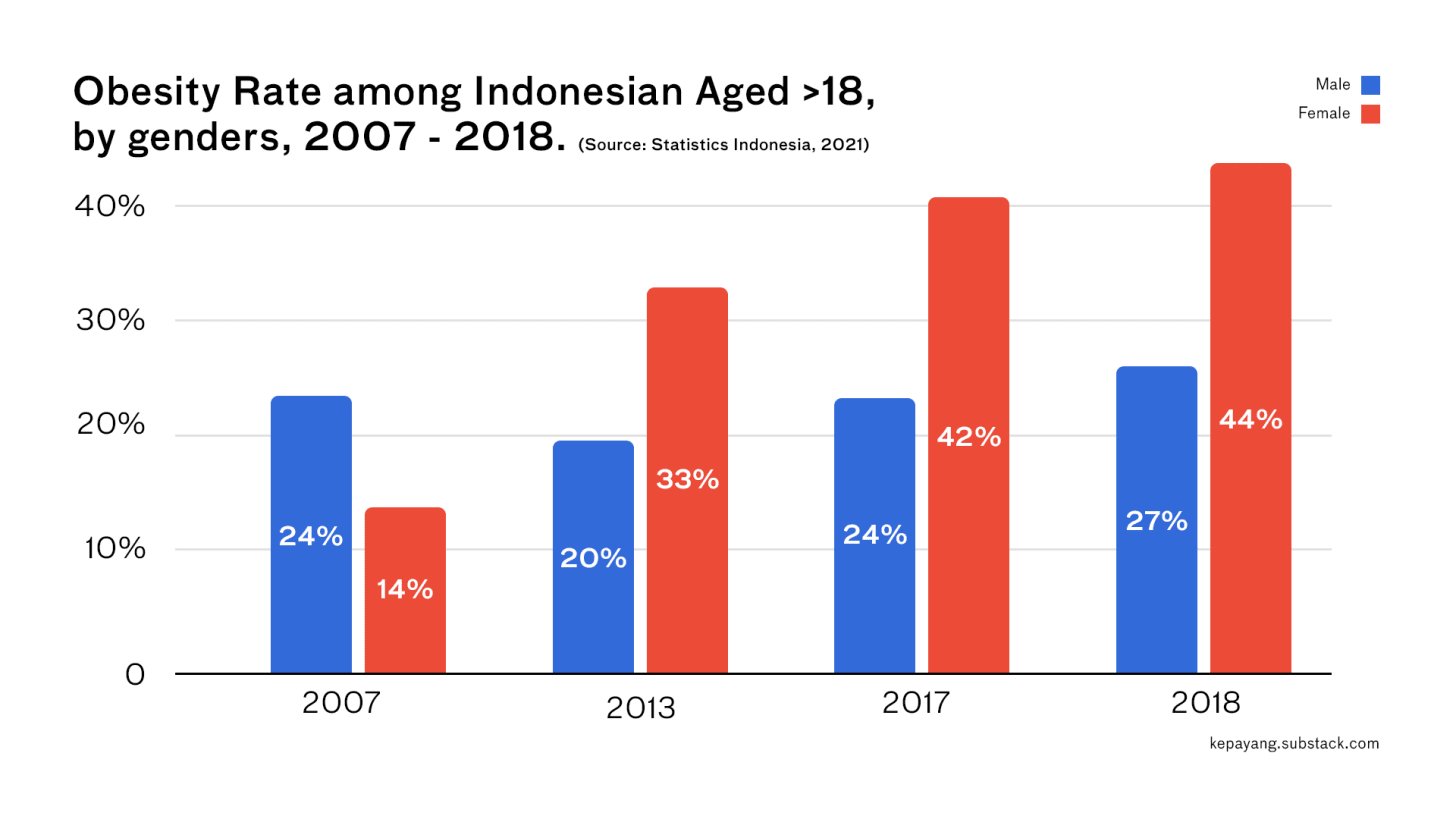

Well, a tax, or in this case, an additional tax may be imposed on goods for certain reasons such as to shape consumer purchasing behaviour. Here, the Ministry of Finance proposed an extra tax on sweetened beverages, which will result in a price increase, in the hope of steering consumers towards healthier drink options. This initiative is deemed crucial, especially since obesity cases across Indonesia have been rapidly increasing in the past few years and are associated with an overconsumption of sugar.

Of course, this cause is also fully backed up by the Ministry of Health. Which makes it beneficial for multiple parties. In simple terms, the Ministry of Finance will get more tax, and the Ministry of Health will be able to improve public health. Unfortunately, the joint effort would also mean a longer process, trickier negotiation, and back-and-forth interdepartmental discussion, which probably explains why we’re still waiting for it to happen.

BPOM, the Indonesian Food and Drug Authority advises producers to look into their current sweetened drink products and reformulate them so that they won’t exceed the 6g of sugars per 100ml taxable threshold (Kontan, 2024). The tax will then be divided into three tiers:

The first tier will be imposed on drinks that have more than 6g of sugar every 100ml.

The second tier will be imposed on drinks with natural sweeteners of any amount.

The third tier will be imposed on drinks with artificial sweeteners of any amount.

And as expected, the actual taxable amount that companies should pay is yet to be confirmed.

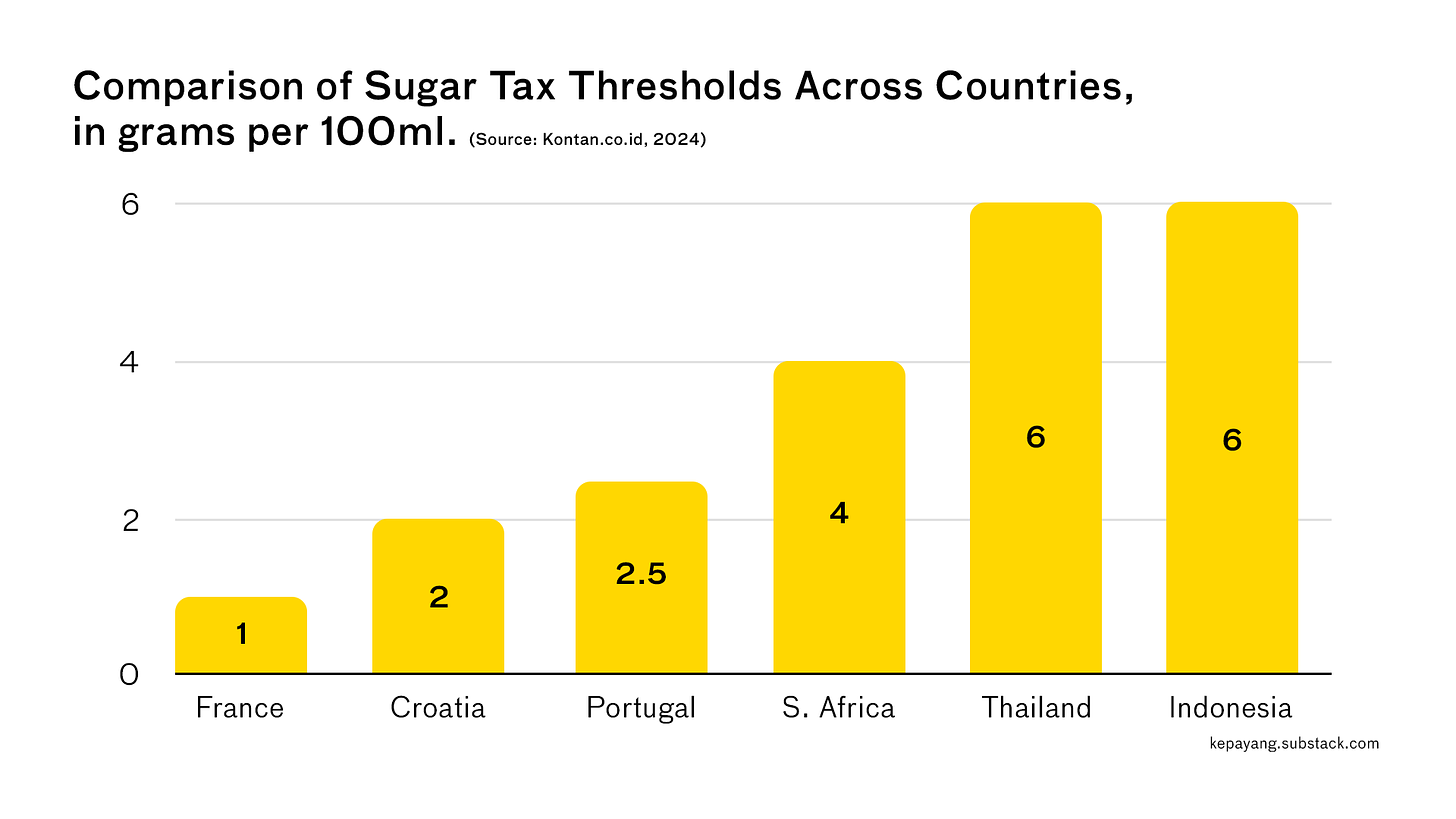

The 6g threshold though, is pretty relaxed - a decision that one might think is inefficient, but I believe is a good starting point. You see, people don’t like changes. They resist. So introducing a rather high threshold will give more wiggle room for both companies to reformulate their products and for consumers to transition to healthier options. To put it in perspective, let’s compare it with the threshold set by other countries (Source: Kontan.co.id, 2024):

Now that we have the threshold, let's check out how our local products measure up.

To find out, I went to my favourite supermarket to compile the data. I guess, I’m in my researcher era or whatever!

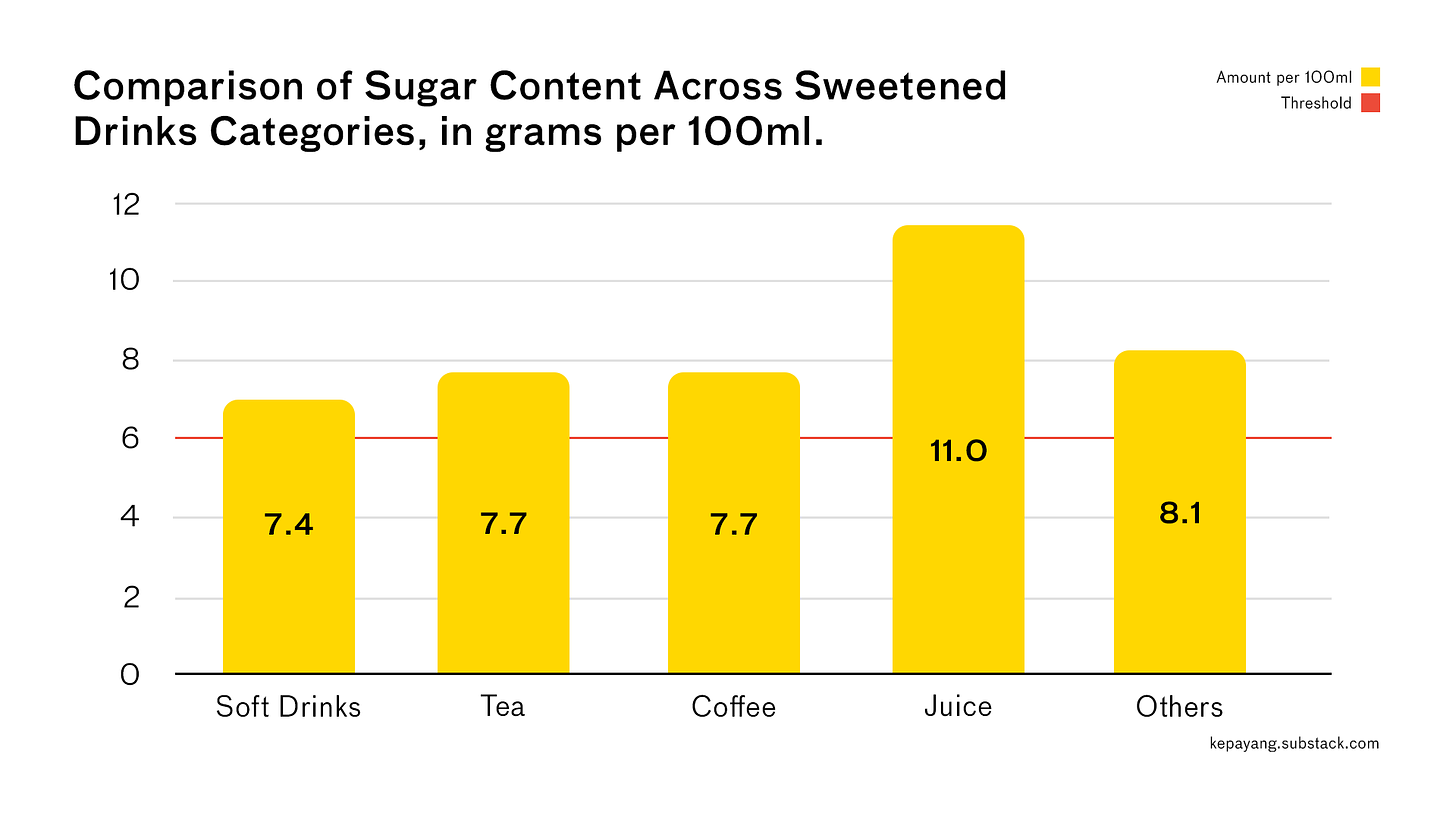

I selected five sweetened drinks from five different categories – soft drinks, juice, tea, coffee, and others. I checked the nutritional facts on the packaging, noted the sugar content per serving, and calculated how much sugar there would be in a 100ml serving. The results are as expected, with a little surprise.

Of all the 25 sweetened drinks, 80% did not meet the threshold of having less than 6g sugar per 100ml. That means only five drinks can stay the same without reformulation. Those five drinks are Pocari Sweat, Hydrococo, and surprise surprise, Fanta, Sprite, and A&W Sarsaparilla which are all soft drinks. Seeing most of the drinks have more than the advised amount of sugar doesn’t surprise me. But seeing Fanta and Sprite were good to go? That’s insane.

The initial takeaway here is to always read the label. It’s common to hear that soft drinks are bad for you, be it from the sugar, colourings, and preservatives. And they might be right. All these sugary drinks aren’t the best for you. But I don’t think it’s fair to dump all the fault on soft drinks when Yakult has literally three times the amount of sugar per 100ml.

So, what’s next?

When a drink doesn’t meet the 6g of sugar per 100ml threshold, there are two options that a company can choose. Both come with their pros and cons.

First, a company can choose to keep their product as is, and just suck the added taxes up.

Doing this helped the company to maintain the consistency of its product, which is important especially if consumers have built a familiarity and trust in them. In return for not going the reformulation route, companies will need to compromise on product pricing. The additional taxes mean more cost to companies, and this may translate to an increase in the price consumers have to pay.

Previously, a price increase due to a sugar tax has been observed in Mexico. In 2014, Mexico introduced a sugar tax of 1 peso per litre on sweetened beverages. As a result, prices of soft drinks rose by about 11%, and sales of sweetened beverages in 2016 decreased by 37% when compared to the year before the tax. Looking at this situation from a public health perspective, this is definitely a slay. But losing more than a third of your sales is also not it for the companies.

This then brings us to the second option, which is product reformulation.

Some companies may avoid this strategy as reformulation costs a fortune and takes a while to perfect. Plus, it may also alter the product’s taste and quality – something that most companies, if not all, don’t want to jeopardise.

This problem happens more often than you think, and as a consumer, it sucks. An article from Vittles Magazine (2024), compiled peoples’ experiences on how the sugar tax ruined soft drinks. For example, the new Nestle’s Sanpellegrino, with 40% stevia, made it “somehow, both too sweet and not sweet enough”, and the swap from sugar to artificial sweeteners in Mitsuya Cider can be a health hazard for those who suffer a Chron’s disease.

These choices aren’t simple, and many companies have been hesitant about this tax.

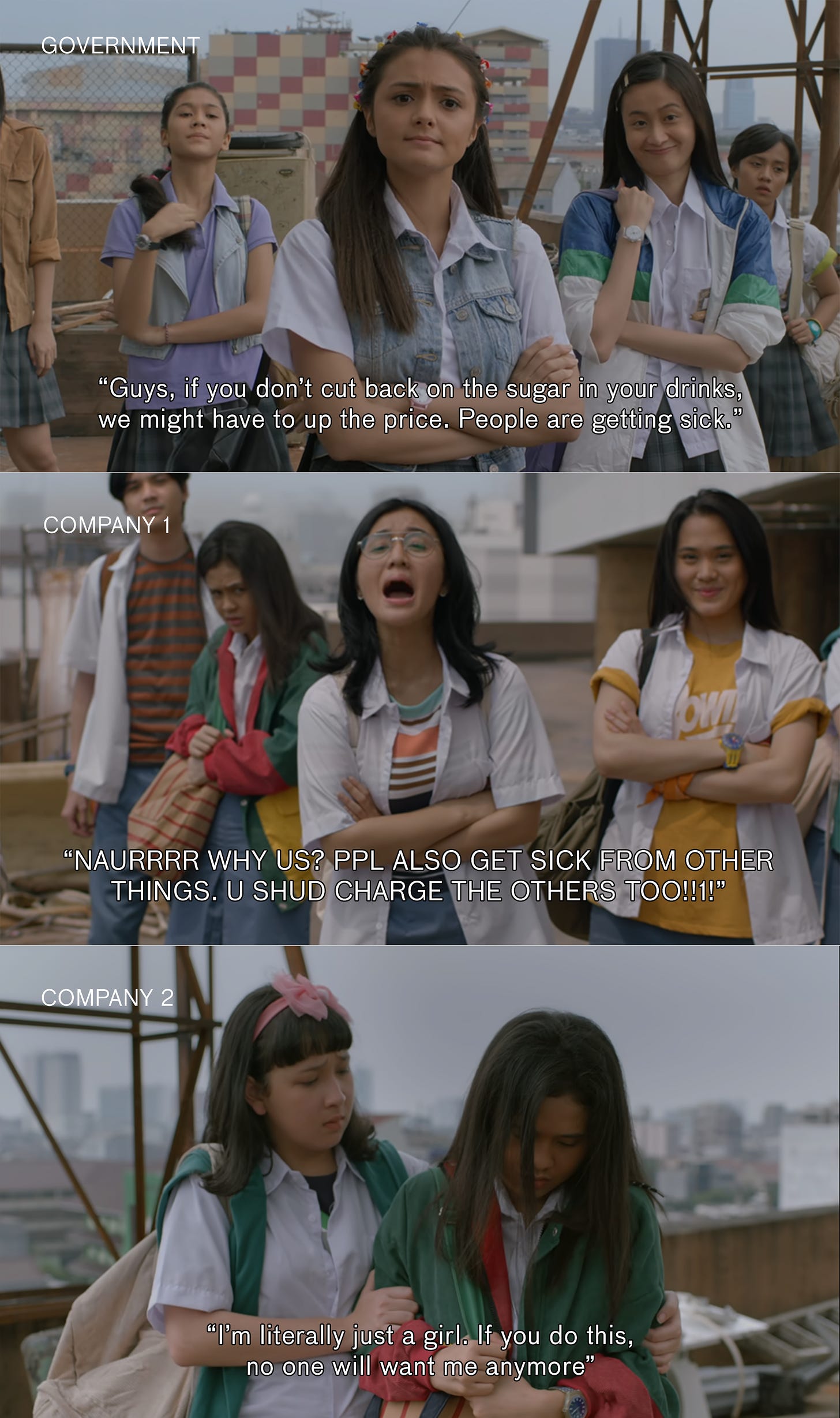

Few associations have explicitly stated their opposition to the sugar tax. Gabungan Produsen Makanan dan Minuman (lit.Association of Food and Beverage Producers) for example, felt that sugar consumption belonged to the personal realm, something that is better addressed through extensive education rather than through retail price interventions. Meanwhile, Asosiasi Industri Minuman Ringan (lit. Association of Soft Drink Industry), expressed that the sugar tax will only hike prices and limit product accessibility. Plus if it’s really about health, then the government should also think about imposing taxes on other products that contribute to obesity, not just sugary drinks.

Too much for a Monday morning? It probably went like this:

While many companies are probably still having beef with this ongoing tax plan, consumers are totally on board with it. In 2022, the Center for Indonesia’s Strategic Development Initiatives (cisdi) surveyed more than 2,600 people across Indonesia to find out how they feel about the sugar tax. The survey found that most respondents (80%) are in favour of the proposed tax, and 85% of respondents are willing to reduce sweetened drinks consumption if the tax is to be passed.

I know, the second bit might not be something that companies want to hear, so here’s some better news for you drink makers:

97% of respondents actually feel that sweetened drinks in Indonesia are generally, if not, very affordable.

Yes, consumption will inevitably go down, but hopefully, it won’t drop as much as you’re worried about.

To conclude, we live in a sugary society. As someone who enjoys a sweet drink, the recent obesity trends have prompted me to pay closer attention to what I consume daily. So knowing that my government, even though they’re rather slow and late to the game, is planning to help us deter from overconsuming sugar made me feel hopeful. Of course, the sugar tax came with implications for both companies and consumers. side. I hope that this plan is carefully considered, calculated, and implemented as soon as possible.

What does your relationship look like with sugary drinks? Do you have any plans to change your consumption habits? Comment down below!

Further reading: If you’re interested in how policy can influence how we consume food, read how Singapore recently introduced mandatory beverage labelling across the island here. For my Indonesian readers, you can also check a similar initiative by Superindo, implemented since early last year here. Slay.

Other contents that I made recently:

🇦🇪 Read the first part of my Emirati food adventure: here.

🇦🇪 Read the second part of my Emirati food adventure: here.

📖 Read last week’s guest post by Mangan on Indonesian breakfast: here.

🍞 Read an essay on Indonesia’s wheat dependency problem: here.

If you like today’s newsletter, please like and share it with your friends! Comment down below your thoughts and let me know if you have any other topics you want me to discuss. Until then, I’ll see you in two weeks!

Follow me everywhere:

TikTok: @berusahavegan

Kepayang’s Instagram: @readkepayang

Instagram: @menggemaskan

LinkedIn: Chalafabia Haris

Work with me: readkepayang@gmail.com